Balancing budget and employee choice in flexible benefits schemes revisited

Learn how UK employers can design flexible benefits schemes that balance cost control with employee choice. Discover lifecycle-aligned strategies to enhance your EVP and workplace wellbeing.

Earlier this year, we looked at how a well-structured flexible benefits scheme can make sense for employers whilst improving engagement and retention. We revisit this theme here.

Why Flexible Benefits Matter in 2025

As the war for talent intensifies, UK employers are rethinking their approach to employee benefits. Flexible benefits schemes — also known as flex benefits or cafeteria plans — are gaining traction as a way to personalise the employee experience while reinforcing the company’s employee value proposition (EVP). But how do you offer meaningful choice without blowing the budget?

This article explores how HR leaders can balance cost control with employee empowerment by designing flexible benefits that align with workforce needs, business goals, and lifecycle stages.

What Are Flexible Benefits Schemes?

Flexible benefits schemes allow employees to tailor their benefits package from a menu of options. These might include:

- Private medical insurance

- Dental or vision coverage

- Gym memberships or wellness stipends

- Mental health support

- Pension top-ups or financial planning tools

- Childcare vouchers or parental leave enhancements

Employees typically receive a fixed allowance or points to allocate across these options. This flexibility supports diverse lifestyles and life stages — a key differentiator in today’s multigenerational workforce.

The Budget Challenge: Managing Costs Without Sacrificing Value

While flexibility is attractive, it introduces complexity. Employers must manage:

- Cost predictability: Forecasting benefits spend when choices vary by employee

- Administrative complexity: Managing multiple providers, compliance, and payroll integration

- ROI measurement: Proving the impact of benefits on retention, engagement, and productivity

In sectors with tight margins — such as retail, hospitality, or education — offering expansive benefits menus can strain budgets. That’s why strategic design is essential.

Strategic Design: How to Balance Budget and Choice

Here are five proven strategies to help HR teams design sustainable, flexible benefits schemes:

- Modular Benefits Frameworks

Structure your offering into core benefits (e.g., statutory pension, life insurance) and flexible modules employees can personalise.

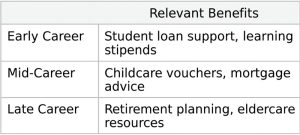

- Lifecycle-Based Benefits

Align benefits with key life stages:

- Tiered Flex Allowances

Offer different flex budgets based on job level, tenure, or performance.

- Data-Driven Optimisation

Use HR analytics to track benefit uptake, satisfaction, and cost-effectiveness.

- Digital Benefits Platforms

Invest in a user-friendly portal that allows self-service enrolment and integrates with payroll.

Enhancing Your EVP Through Benefits

Flexible benefits are a powerful tool for strengthening your EVP. To maximise impact:

- Communicate the “why” behind your benefits strategy

- Offer guidance to help employees make informed choices

- Share real-life stories of how benefits have helped colleagues

- Link benefits to broader themes like sustainability and inclusion

Common Pitfalls to Avoid

When designing or updating your flexible benefits scheme, watch out for:

- Perceived inequality: Ensure all employees feel they have meaningful options

- Decision fatigue: Too many choices can overwhelm employees

- Data privacy risks: Ensure compliance with GDPR and other regulations

- Lack of governance: Regularly review providers, costs, and employee feedback

Future Trends: What’s Next for Flexible Benefits?

Looking ahead to 2026 and beyond, expect to see:

- Greater integration of global benefits platforms

- Increased focus on mental health and neurodiversity support

- More financial wellbeing tools, including salary advance and budgeting apps

- Benefits aligned with hybrid and remote work lifestyles

Conclusion: Flexibility with Foresight

Flexible benefits schemes are no longer a “nice to have” — they’re a strategic imperative. By aligning benefits with the employee lifecycle and using data to guide decisions, employers can offer meaningful choice without compromising budget discipline.

The key is to treat benefits not just as a cost centre, but as a value driver — one that supports wellbeing, engagement, and long-term business performance.

The Next Step

Designing a flexible benefits scheme that truly works — for both your employees and your bottom line — requires more than good intentions. It demands strategic planning, financial insight, and a clear understanding of tax implications, especially in the UK’s evolving regulatory landscape.

That’s why your next step should be to speak with us. Whether you’re reviewing your current benefits structure or building a new scheme from scratch, we can help you:

- Assess the financial viability of different benefits models

- Understand tax efficiencies and employer obligations

- Align benefits with long-term workforce planning

- Ensure compliance with UK employment and pension regulations

We can also help you tailor benefits to your workforce demographics, ensuring your scheme supports wellbeing, retention, and productivity.

Ready to take the next step?

Reach out to us today to explore how flexible benefits can become a strategic asset for your organisation.